st louis county personal property tax rate

Louis County collects on average 125 of a propertys. 41 South Central Avenue 3rd Floor Clayton MO 63105.

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

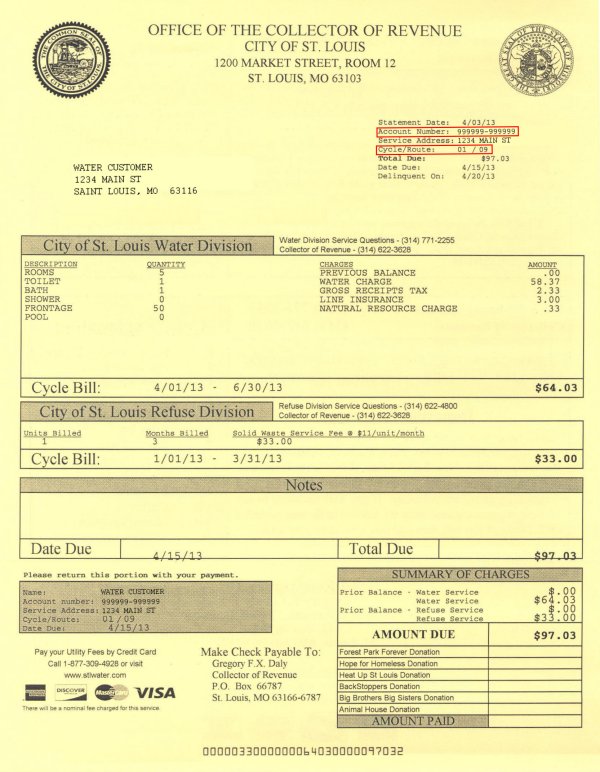

Mail payment and Property Tax Statement coupon to.

. If the accepted payment is less than the. Account Number number 700280. October 17th - 2nd Half Real Estate and Personal Property Taxes are due.

Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. Account Number or Address. Louis City collects on average.

The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. August 31st - 1st Half Manufactured Home Taxes. To declare your personal property declare online by April 1st or download the printable forms.

The median property tax in St. May 16th - 1st Half Real Estate and Personal Property Taxes are due. The median property tax also known as real estate tax in St.

Yearly median tax in St. Louis County is 223800 per year based on a median home value of 17930000 and a median. Account Number number 700280.

Louis County Auditors Tax Division accepts payments of more or less than the exact amount of a tax installment due for the current year. If you own any personal property in St. Louis County you will need to pay your.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Louis County collects on average 125 of a propertys. November 15th - 2nd Half Agricultural Property Taxes are due.

To declare your personal property declare online by April 1st or download the printable forms. The tax rate for personal property tax in St. Louis County is 2150 per 100 of assessed value.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. The median property tax in St. Monday - Friday 8 AM - 500 PM NW Crossings South County.

Pay a Parking Ticket How to pay a parking. Provides formulas used to calculate personal property residential real property and commercial real property. Account Number or Address.

Louis City Missouri is 1119 per year for a home worth the median value of 122200. Online Payments and Forms - St. The value of your personal property is assessed.

Monday - Friday 8AM - 430PM. 41 South Central Clayton MO 63105. Monday - Friday 830 AM - 430 PM.

The median property tax in St.

Hennepin County Mn Property Tax Calculator Smartasset

Tax Rates Summary St Louis County Website

Online Payments And Forms St Louis County Website

County Historian St Louis Regional History Organizations

Online Payments And Forms St Louis County Website

Collector Of Revenue St Louis County Website

Job Opportunities Sorted By Job Title Ascending St Louis County Missouri Careers

Collector Of Revenue St Louis County Website

Concord News St Louis Call Newspapers

Collector Of Revenue St Louis County Website

Sheriff St Louis County Courts 21st Judicial Circuit

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Missouri Property Tax Calculator Smartasset

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022

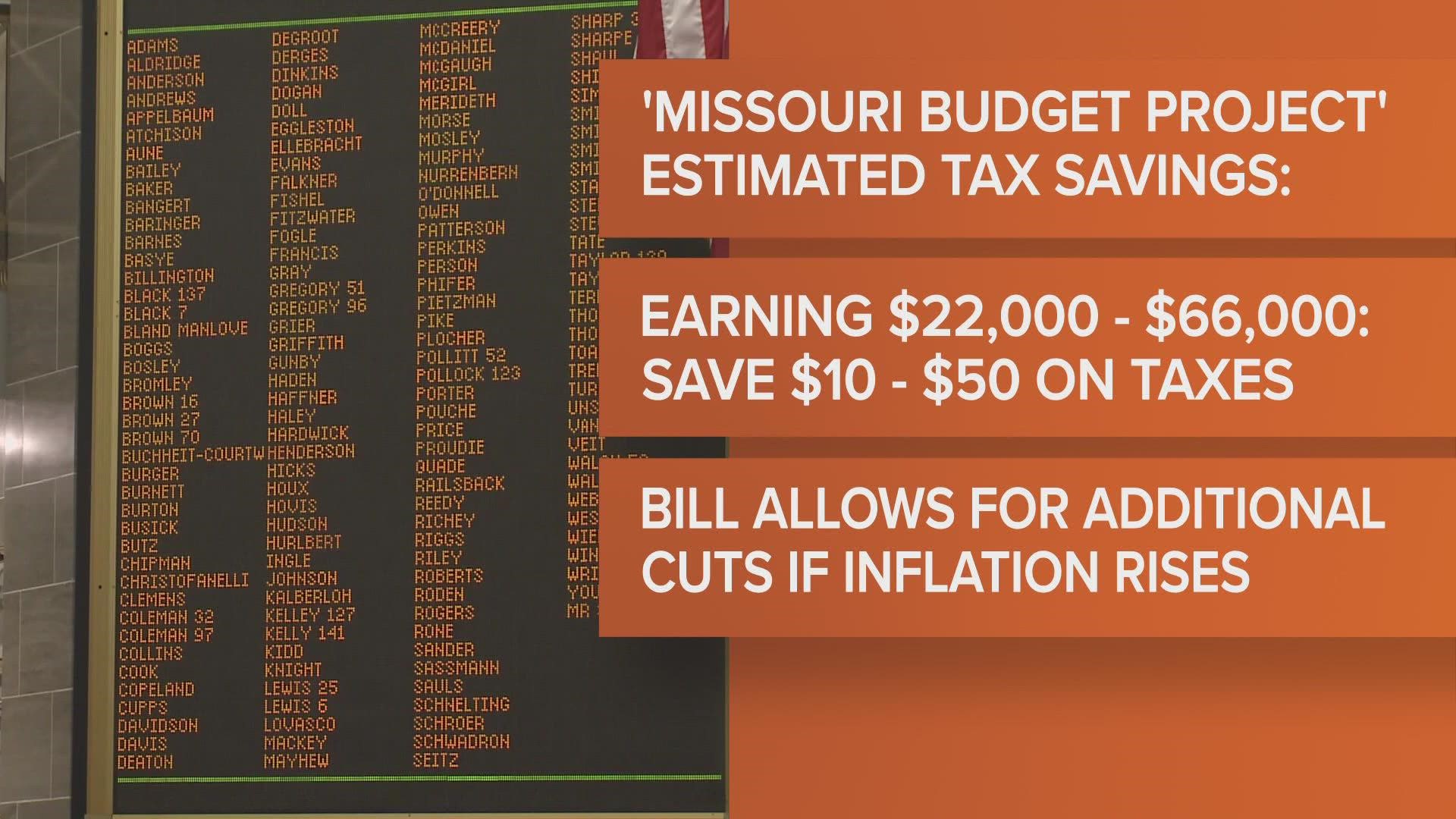

Missouri Lawmakers Pass Bill To Cut Income Taxes Ksdk Com

Opinion How Lower Income Americans Get Cheated On Property Taxes The New York Times